Bài đăng

**Title: Top Industry Conferences and Events for 2024: Expanding Networks and Staying Ahead of Trends** **Introduction** In 2024, professionals in the manufacturing, logistics, and technology industries have a multitude of opportunities to enhance their knowledge, expand their networks, and keep abreast of the latest trends. Attending industry conferences and events is not only crucial for learning, but also for networking, discovering emerging technologies, and gaining a competitive edge. In this blog post, we will highlight the top events in 2024 that professionals in these industries cannot afford to miss. **Why Industry Events Are Essential** Industry events provide a unique space for professionals to share insights, explore new trends, and connect with peers. Attending conferences goes beyond just gaining knowledge - it is about networking, understanding the competitive landscape, and discovering emerging technologies. By participating in industry events, professionals can: - **Gain insights**: Stay updated on the latest advancements in their field. - **Expand their network**: Meet potential clients and partners. - **Learn from experts**: Benefit from the knowledge shared through keynote sessions, panels, and workshops. - **Explore new technologies**: Keep their businesses competitive by exploring cutting-edge technologies. With these benefits in mind, let's dive into the top industry conferences and events of 2024. **Top Industry Conferences in 2024** **1. IMTS - International Manufacturing Technology Show** - **Date**: September 9-14, 2024 - **Location**: Chicago, IL - **Focus**: Advanced manufacturing technologies, automation, robotics IMTS is a must-attend event for professionals in the manufacturing sector. It brings together manufacturers and tech innovators to showcase the latest advancements in advanced manufacturing, robotics, and automation. As one of the largest trade shows globally, IMTS attracts thousands of attendees seeking to streamline production processes and enhance efficiencies. **2. CES 2024** - **Date**: January 9-12, 2024 - **Location**: Las Vegas, NV - **Focus**: Consumer electronics, industrial tech innovation While CES is widely recognized for its focus on consumer electronics, it has expanded its scope to include industrial technology innovations. With a particular emphasis on artificial intelligence (AI), the Internet of Things (IoT), and smart manufacturing, CES 2024 becomes an important event to understand the impact of these technologies on the industrial landscape. **3. Hannover Messe 2024** - **Date**: April 22-26, 2024 - **Location**: Hannover, Germany - **Focus**: Industry 4.0, automation, energy efficiency Hannover Messe is one of the leading industrial trade fairs that covers a wide array of topics, including automation, robotics, digital factories, and energy solutions. With a focus on Industry 4.0, this event welcomes exhibitors and experts who explore how digitalization is transforming industrial operations. From small innovations to large-scale technologies, Hannover Messe is the ideal place to future-proof businesses. **4. MODEX 2024** - **Date**: March 11-14, 2024 - **Location**: Atlanta, GA - **Focus**: Supply chain, logistics, material handling MODEX is a key event for professionals in the supply chain and logistics sectors. With the increasing demand for faster and more efficient supply chains in the era of e-commerce, MODEX highlights cutting-edge technologies such as automation, robotics, and advanced software solutions that streamline logistics operations. **5. FABTECH 2024** - **Date**: November 11-14, 2024 - **Location**: Atlanta, GA - **Focus**: Metal forming, fabricating, welding, finishing FABTECH, North America's largest event focused on metalworking, fabricating, welding, and finishing, is perfect for professionals seeking ways to improve production efficiency. The event offers hands-on demonstrations, expert-led sessions, and exposure to the latest equipment and solutions. **Networking-Focused Industry Events in 2024** **6. Supply Chain & Logistics Expo** - **Date**: June 18-19, 2024 - **Location**: London, UK - **Focus**: Global supply chain strategies and innovations The Supply Chain & Logistics Expo brings together leaders in global supply chain and logistics. It offers insights into the newest trends in procurement, logistics, and supply chain optimization. Networking is at the heart of this conference, making it ideal for building partnerships and learning from industry experts. **7. The Smart Manufacturing Summit** - **Date**: May 22-24, 2024 - **Location**: Los Angeles, CA - **Focus**: Digital transformation and smart manufacturing This summit highlights smart technologies such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics which are reshaping the manufacturing industry. It brings together industry leaders to discuss future challenges and solutions in the manufacturing sector. **8. Industrial Internet of Things (IIoT) World** - **Date**: October 7-9, 2024 - **Location**: Barcelona, Spain - **Focus**: Industrial IoT applications and innovation IIoT World delves into the integration of IoT into industrial processes and covers topics ranging from data-driven decision-making to connected devices and predictive analytics. Professionals interested in understanding how IoT is transforming industrial sectors like energy, manufacturing, and logistics will find this event highly relevant. **Tips to Maximize Your Conference Experience** Attending a conference is a valuable investment, and to maximize its benefits, follow these tips: - **Set goals**: Clearly define your objectives, whether it's networking with specific industry players or learning about a particular innovation. - **Be proactive**: Attend sessions and workshops aligned with your interests and actively participate by asking questions. - **Network smartly**: Make an effort to connect with speakers, exhibitors, and fellow attendees to expand your professional circle. - **Follow up**: After the event, engage with new ideas learned during the conference and ensure you follow up with contacts made. **Conclusion** With the abundance of essential conferences and industry events in 2024, professionals in the manufacturing, logistics, and industrial sectors have numerous opportunities to learn, connect, and innovate. These events provide insights into the latest trends, enable the formation of strategic partnerships, and showcase cutting-edge technologies that can propel businesses forward. Whether your interest lies in automation, smart manufacturing, or supply chain management, there is an event tailored for you in 2024. **External Link Insert: [Check out the top industry conferences and events for 2024 here](https://eiindustrial.com/top-industry-conferences-and-events-for-2024/).**

- Nhận đường liên kết

- X

- Ứng dụng khác

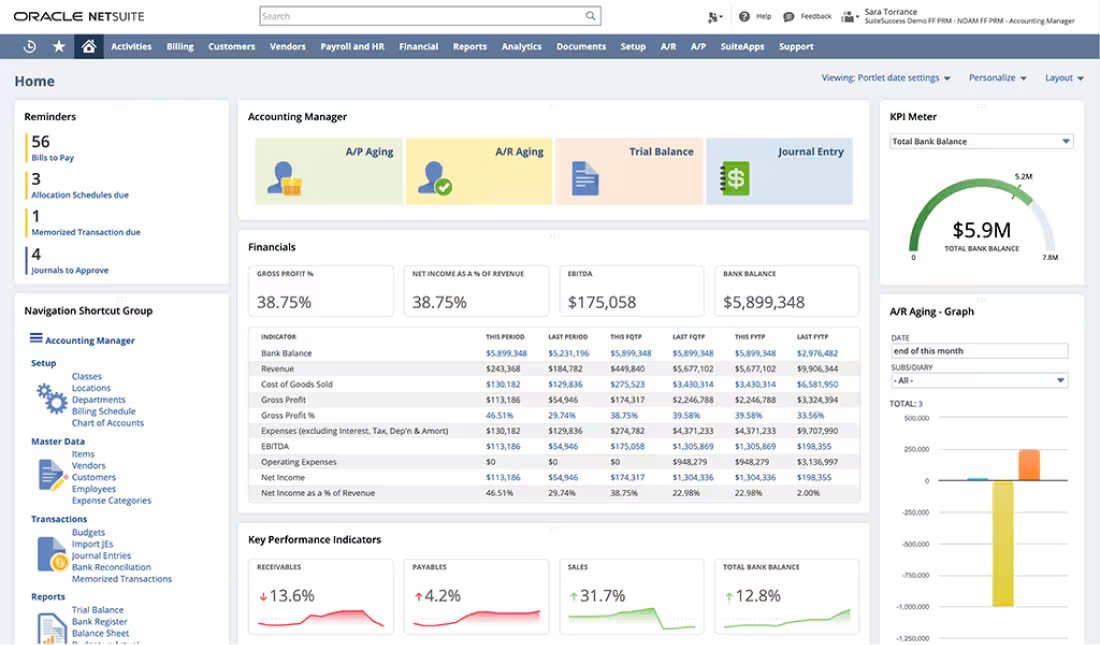

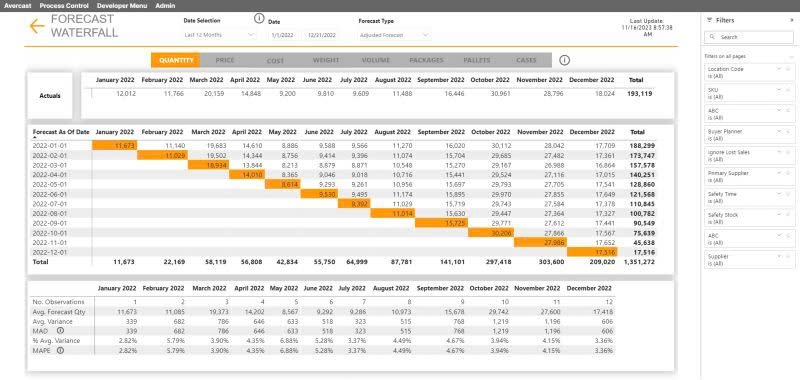

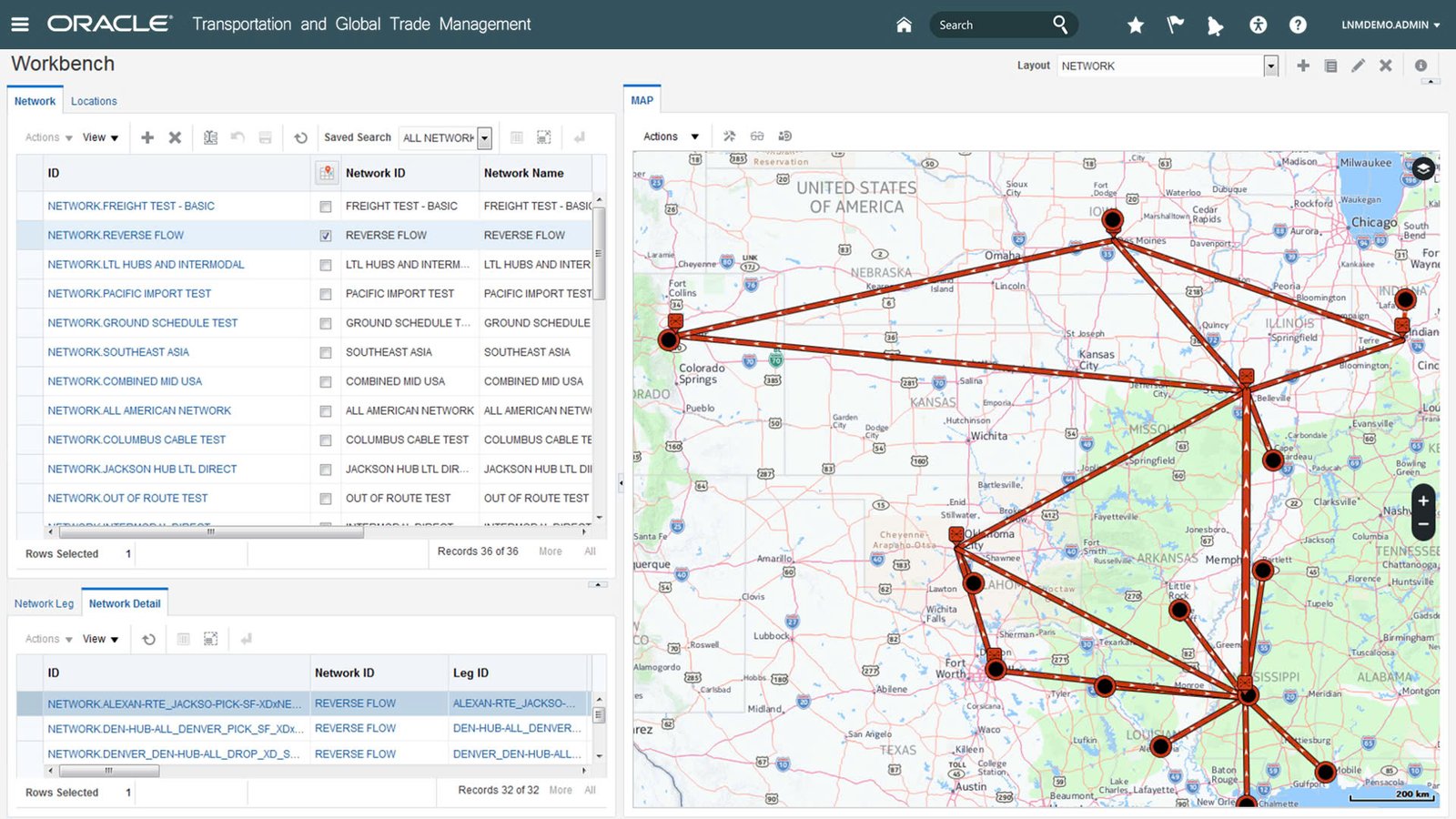

Title: Essential Tools for Supply Chain Management: Streamlining Your Operations Introduction: In today's business landscape, efficient supply chain management has become paramount for businesses striving for greater efficiency. It is no longer just about moving goods from one place to another; it's about utilizing the right supply chain tools and software to streamline operations, enhance visibility, and drive cost savings. In this blog post, we will explore the essential tools that can transform your supply chain and keep your operations running smoothly. Why Supply Chain Tools Matter: As supply chains grow more complex, businesses require real-time data, faster decision-making capabilities, and seamless collaboration across multiple departments. This is where supply chain tools come in. They allow businesses to reduce costs, minimize errors, and adapt to market fluctuations more easily. Whether it's automating processes or forecasting demand, these tools offer significant advantages for businesses aiming to stay competitive. Types of Supply Chain Tools: 1. Inventory Management Tools: Efficiently managing inventory is critical to preventing stockouts or overstocking. Fishbowl and NetSuite are two popular inventory management tools that provide real-time stock level monitoring, allowing businesses to optimize reorder points and warehouse space. This not only saves costs but also ensures the availability of the right amount of stock.  2. Demand Forecasting Tools: Accurately predicting future demand helps businesses maintain optimal inventory levels and avoid waste. Tools like SAP Integrated Business Planning and Avercast utilize advanced algorithms to analyze historical data, seasonal trends, and market conditions. By using demand forecasting software, companies can anticipate customer needs and adjust their production schedules accordingly.  3. Procurement Software: Effective procurement is the backbone of any well-run supply chain. Software like SAP Ariba and Oracle Procurement Cloud streamlines supplier relationships, automates purchase orders, and manages vendor contracts. These tools not only ensure that businesses can secure the best prices but also reduce procurement cycle times. 4. Transportation Management Systems (TMS): Transportation costs typically form a significant portion of a company's budget. A robust Transportation Management System (TMS) can lead to massive savings. Systems like Oracle TMS and Kuebix help optimize shipping routes, manage carrier contracts, and monitor fuel costs. Enhancing logistics performance, this software ensures faster and more economical product deliveries.  5. Warehouse Management Systems (WMS): Precise coordination is essential for warehouse operations, from receiving goods to fulfilling orders. Warehouse Management Systems (WMS) like Manhattan WMS and HighJump help manage storage, picking, packing, and shipping. Implementing a WMS ensures accuracy, minimizes manual labor, and enhances order fulfillment speeds. Advanced Tools with AI and Automation: AI-driven supply chain tools, such as Llamasoft and ClearMetal, are reshaping the future of logistics and operations. These tools utilize predictive analytics to forecast demand patterns, optimize routes, and reduce bottlenecks. Automation, on the other hand, reduces human errors and increases operational speed. Automated warehousing systems, AI-driven demand forecasting, and smart procurement are becoming the new supply chain optimization standards. Key Benefits of Using Supply Chain Software: Investing in the right supply chain software offers several benefits: - Enhanced visibility: Real-time tracking of shipments, inventory, and costs across the entire supply chain. - Cost reduction: Automation and optimization tools help cut down on labor, fuel, and inventory costs. - Better coordination: Integrated platforms enable seamless collaboration among different departments, from procurement to logistics. - Improved customer satisfaction: Faster deliveries and fewer mistakes result in happier customers and better retention rates.  Choosing the Right Tool for Your Business: When selecting the best supply chain tool for your company, consider the following factors: - Business size: Opt for simple, cost-effective solutions for small businesses and robust, scalable software for larger enterprises. - Specific needs: Identify whether your business prioritizes inventory management, demand forecasting, or logistics to narrow down your requirements. - Budget: Strike a balance between a tool's capabilities and your budget. - Integration capabilities: Choose software that seamlessly integrates with your existing systems for smooth data flow between departments. Consulting supply chain experts can provide valuable insights into the tools that best suit your business's current and future needs. Conclusion: The right supply chain tools and software can significantly enhance operational efficiency, reduce costs, and provide better visibility into supply chain processes. In an increasingly globalized and complex supply chain landscape, leveraging these tools is essential for businesses looking to thrive. By investing in the right technology, you set your business up for success now and in the future. Read the original article here: [Essential Tools for Supply Chain Management: Streamlining Your Operations](https://eiindustrial.com/essential-tools-for-supply-chain-management-streamlining-your-operations/)

- Nhận đường liên kết

- X

- Ứng dụng khác

Government Grants and Incentives for Industrial Innovationbudge

- Nhận đường liên kết

- X

- Ứng dụng khác

Title: Angel Investors: A Key Source of Early-Stage Funding for Startups Introduction: Angel investors play a crucial role in supporting startups through early-stage funding, providing the necessary financial lifeline for entrepreneurs to bring their ideas to life. In this blog post, we will explore the importance of angel investors, how they differ from other funding sources, and discover effective strategies for attracting these investors. What is Early-Stage Funding? Early-stage funding refers to the capital raised by a startup during its initial phase, when it is still validating its business model or launching its first product. These funds are essential for covering development costs, market research, and early marketing efforts. Angel investors are an invaluable source of funding at this stage, as startups often struggle to secure traditional funding due to the high risk and lack of a proven track record. What Are Angel Investors? Angel investors are typically high-net-worth individuals who provide funding to startups in exchange for equity or convertible debt. Unlike venture capitalists (VCs), angel investors use their personal wealth and tend to have more flexible investment criteria. They support startups in their earliest and riskiest phase, bridging the gap between friends-and-family funding and institutional investment. Benefits of Angel Investors: 1. Financial Support: Angel investors inject crucial capital into startups, enabling founders to fund product development, marketing, and operations without taking on significant debt or diluting their equity too early. 2. Mentorship and Strategic Guidance: Many angel investors have extensive business experience and can offer invaluable mentorship and strategic advice to new entrepreneurs. 3. Networking and Industry Connections: In addition to funding and advice, angel investors can open doors for startups through their professional networks, leading to new business opportunities, partnerships, and future rounds of funding. Angel Investment Risk: While startups gain many benefits from angel investing, it comes with significant risks: - High Failure Rates: Startups often have high failure rates, and angel investors must accept the possibility of losing their investment. - Lack of Liquidity: Investments in startups are usually long-term, and it may take years before angel investors see any return, if at all. - Unpredictable Outcomes: The success of startups can be volatile, and numerous factors can derail even the most promising ideas, including market conditions and competition. How to Attract Angel Investors: Attracting angel investors requires more than just a good idea; it involves demonstrating your startup's potential and showcasing your competency as an entrepreneur. Here are some strategies: 1. Build Your Network: Leverage personal and professional connections, attend industry events, startup pitch competitions, and join entrepreneurial networks to meet potential investors. 2. Perfect Your Pitch: Create a compelling pitch that clearly communicates your business idea, target market, and growth potential. Prepare a well-thought-out business plan and financial projections. 3. Show Early Traction: Demonstrate early signs of success, such as a growing user base, positive customer feedback, or initial sales, to prove your startup's potential to angel investors. 4. Be Prepared for Negotiations: Understand the valuation of your startup and be ready to negotiate the percentage of equity you are willing to give up in exchange for investment. Conclusion: The Role of Angel Investors in Innovation: Angel investors play a vital role in the startup ecosystem by providing essential early-stage funding, mentorship, advice, and access to valuable networks. However, both entrepreneurs and investors must be aware of the significant risks involved in angel investing. By presenting a strong case for investment and understanding the long-term commitment required, entrepreneurs can harness the power of angel investors to turn their bold ideas into reality. For more information on angel investors and their role in early-stage funding for startups, visit eiindustrial.com.

- Nhận đường liên kết

- X

- Ứng dụng khác

Crowdfunding Success for Industrial Projects: Strategies to Secure Funding

Crowdfunding has emerged as a powerful tool for industrial projects seeking financial backing. However, the key to success lies in more than just having a good idea. To stand out in the increasingly competitive crowdfunding space, project owners must employ strategic approaches to attract and secure investments. In this article, we will explore effective strategies that can ensure the success of your industrial project in the world of crowdfunding.

1. Create a Compelling Narrative

Every successful crowdfunding campaign starts with a strong story. For industrial projects, it is crucial to explain not only what your project does but also why it matters. Investors and backers are more likely to support projects with clear objectives and evident societal benefits.

To build a compelling narrative, focus on:

- Clearly defining project goals.

- Using visuals, such as concept designs, prototypes, or videos, to enhance understanding.

- Highlighting real-world impact projections, such as savings, efficiency, or sustainability benefits.

An example of this approach would be a startup emphasizing how their revolutionary energy-efficient manufacturing process reduces carbon emissions, benefiting both the industry and the environment.

2. Offer Transparent Financial Planning

Transparency is crucial when large sums of money are involved in industrial projects. Providing clear and detailed financial projections can make or break your crowdfunding campaign. Investors want to know how their funds will be used and that careful planning has been undertaken.

Include a breakdown of:

- Material costs: Identify raw materials and manufacturing components.

- Labor costs: Specify workforce-related expenses, including engineers or technicians.

- Development timeline: Outline the estimated duration and costs of each phase of the project.

Being upfront about these costs demonstrates to investors that you have carefully considered the practicalities of your project.

3. Build a Community Before Launch

Pre-launch efforts play a significant role in the success of a crowdfunding campaign. Before taking your industrial project live, focus on creating a supportive and interested community. Leverage social media, newsletters, and industry networking events to generate early interest.

Cultivate relationships with potential backers, industry leaders, and thought leaders who can amplify your project. Engage with your community by:

- Regularly posting updates about your project’s progress.

- Seeking feedback to refine your pitch and improve the project.

- Hosting webinars or discussions to introduce potential backers to the project.

4. Leverage Social Proof to Build Momentum

Social proof plays a crucial role in crowdfunding campaigns. When potential investors see that others have already backed your industrial project, they are more likely to join in. Early backing, especially from reputable figures or organizations, creates trust and momentum for your campaign.

To establish social proof early on, consider:

- Securing high-profile endorsements or partnerships prior to launching.

- Offering exclusive deals or early-bird rewards to initial backers.

- Using testimonials or quotes from industry professionals to lend credibility.

Having early supporters will help your project gain traction more quickly and maintain steady interest throughout the campaign.

5. Offer Relevant and Valuable Rewards

Crowdfunding thrives on the idea of incentivizing backers. Offering appealing and meaningful rewards can significantly enhance the success of your campaign, especially in the industrial space. Rewards should closely align with your project, making them attractive to both individual contributors and potential corporate partners.

For industrial projects, consider offering rewards such as:

- Exclusive access to new technology or tools your project is developing.

- The opportunity for backers to influence design or development decisions.

- Product discounts for early backers.

While crowdfunding for industrial projects often targets equity or large-scale backers, offering perks to smaller investors can help create a diverse pool of supporters.

6. Utilize Targeted Marketing and Outreach

A well-planned marketing strategy is essential for crowdfunding success. For industrial projects, it is crucial to focus on targeting specific audiences, such as industry professionals, engineers, or eco-conscious investors. Tailor your campaign’s messaging to resonate with your ideal backers.

Key strategies for targeted marketing and outreach include:

- Social media outreach: Utilize platforms like LinkedIn, Twitter, and industry-specific forums to connect with potential supporters.

- Press and media coverage: Collaborate with relevant blogs, trade publications, and influencers to spread the word about your crowdfunding campaign.

- Video campaigns: Use videos to explain your project’s purpose and demonstrate its potential impact.

Consistent communication is crucial for successful outreach. Regularly post updates to keep your backers engaged and encourage additional contributions.

7. Consider Hybrid Funding Models

While traditional crowdfunding models are prevalent for industrial projects, hybrid approaches that combine crowdfunding with institutional investments or grants can increase your project’s chances of success. Incorporating both public and private funding options not only diversifies capital sources but also demonstrates wider support and reduces perceived risk.

8. Focus on Post-Campaign Engagement

Securing funding through crowdfunding is just the beginning. To maintain long-term relationships with your backers, it is vital to maintain engagement even after the campaign ends. Regularly update your supporters on project progress, share information about fund allocation, and remain transparent about any challenges or delays that arise.

In conclusion, crowdfunding offers industrial projects a unique opportunity to secure funding while building an engaged community of supporters. To thrive, prepare meticulously, communicate clearly, and strategize your outreach efforts. By creating a compelling narrative, offering transparent financial planning, building early engagement, and leveraging social proof, industrial innovators can unlock the full potential of crowdfunding to bring their projects to life in the ever-evolving industrial sector.

For more information, you can visit the original article here.

- Nhận đường liên kết

- X

- Ứng dụng khác

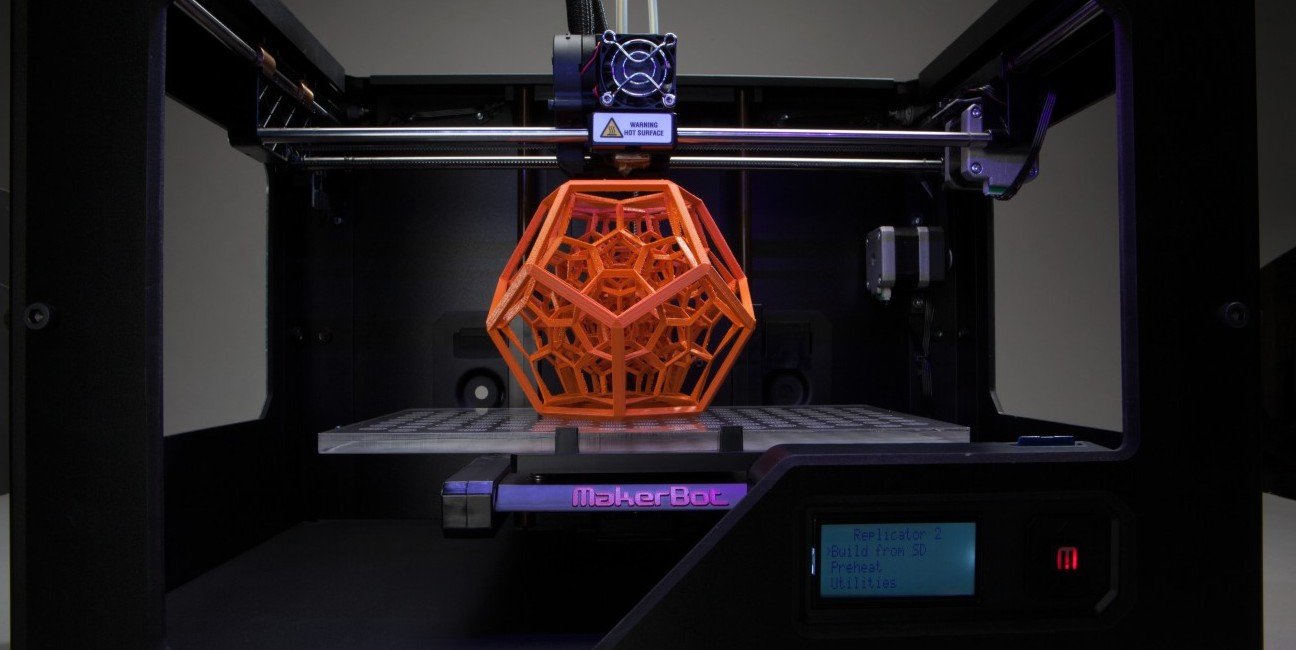

Title: Venture Capital in the Industrial Sector: Key Trends and Opportunities Introduction: The venture capital (VC) landscape is rapidly evolving, witnessing significant growth in sectors driven by technological innovation and sustainability. The industrial sector, known for its conservative approach to adopting new technologies, is now experiencing a transformation with venture capital opening doors to unprecedented opportunities. This shift has enabled startups and established industrial companies to attract funding for cutting-edge solutions that aim to disrupt traditional processes and enhance efficiencies. In this blog post, we will explore the key trends and investment themes driving venture capital in the industrial sector. H1: Green Technology and Sustainability in the Industrial Sector Sustainability has become a cornerstone of industrial investments, with companies and investors aligning their strategies with environmental, social, and governance (ESG) principles. Venture capitalists are actively funding startups that develop green technologies, aiming to reduce the industrial sector's carbon footprint. This trend is driving the adoption of clean energy sources and addressing waste reduction and sustainable production processes within industries like mining, manufacturing, and logistics. Key areas within this trend include: 1. Circular Economy Initiatives: Promoting the reuse and recycling of materials. 2. Energy-efficient Manufacturing: Implementing renewable energy sources in factories and production lines. 3. Water Conservation Technologies: Improving water management in heavy industries. Read more: [Source](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/#green-technology-and-sustainability-in-the-industrial-sector) H1: Industrial Automation and Robotics The future of manufacturing lies in automation, with startups driving innovation in robotics, artificial intelligence (AI), and machine learning (ML) receiving significant venture capital investments. The adoption of smart factories, where machines and systems operate autonomously with minimal human intervention, is transforming traditional production processes. Venture capitalists are focusing on startups that leverage: 1. Robotic Process Automation (RPA): Automating repetitive tasks in industrial processes. 2. AI-driven Supply Chains: Optimizing inventory management, reducing waste, and increasing operational efficiency. 3. Predictive Maintenance: Using machine learning to monitor equipment and predict failures, reducing downtime and maintenance costs. Read more: [Source](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/#industrial-automation-and-robotics) H1: 3D Printing and Advanced Manufacturing Additive manufacturing, or 3D printing, is revolutionizing industrial production by offering flexible and cost-effective manufacturing options. Venture capital investments are pouring into startups that offer 3D printing solutions, ranging from new materials and printing technologies to software that integrates additive manufacturing into existing supply chains. Key trends in this space include: 1. Metal 3D Printing: Enabling the production of strong, durable components for heavy industries. 2. On-demand Production: Reducing the need for large inventories by producing parts as needed. 3. Customization: Allowing manufacturers to produce bespoke products tailored to specific customer requirements. Read more: [Source](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/#3d-printing-and-advanced-manufacturing) H1: Industrial IoT and Data-Driven Manufacturing The Industrial Internet of Things (IIoT) is expanding across industrial sectors, enabling better connectivity and data collection throughout the manufacturing process. Venture capitalists are particularly interested in IIoT solutions that offer real-time monitoring, big data analytics, and digital twins. Investments in IIoT are enabling the development of smart factories and data-driven manufacturing ecosystems. Read more: [Source](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/#industrial-iot-and-data-driven-manufacturing) H1: Supply Chain Innovation and Resilience Global supply chains have faced unprecedented disruptions, leading companies to search for innovative solutions to make their supply chains more resilient, efficient, and transparent. Venture capital is flowing into startups that provide technologies like blockchain for supply chain transparency, AI and ML for demand forecasting, and last-mile delivery optimization. These investments help industries mitigate risks and adapt to new market challenges. Read more: [Source](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/#supply-chain-innovation-and-resilience) H1: Energy Storage and Electric Vehicles Energy storage and electric vehicles (EVs) are at the forefront of the industrial sector's transformation towards sustainable energy solutions. Venture capital is being directed towards startups developing advanced energy storage systems and EV infrastructure, such as charging stations and battery technologies. These investments support industries in reducing reliance on fossil fuels and transitioning towards greener operations. Key trends include: 1. Battery Innovation: Enhancing energy storage capacity and lifespan. 2. EV Supply Chain Development: Creating sustainable supply chains for electric vehicle manufacturing. 3. Grid Integration: Supporting the integration of renewable energy sources with industrial power grids. Read more: [Source](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/#energy-storage-and-electric-vehicles) Conclusion: The landscape of venture capital in the industrial sector is rapidly evolving, with emerging sectors like green technology, industrial automation, 3D printing, and supply chain innovation attracting substantial investments. By focusing on key trends, venture capitalists can drive innovation within the industrial sector, unlocking new avenues for success. As the industrial landscape continues to evolve, investments in these emerging sectors will position stakeholders to capitalize on the future of industry. Read the full article on EIIndustrial: [Venture Capital in the Industrial Sector: Key Trends and Opportunities](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/)

- Nhận đường liên kết

- X

- Ứng dụng khác

Title: 8 Steps to Securing Startup Funding: A Comprehensive Guide for Entrepreneurs Introduction: Securing funding is a critical task for startup founders. Whether you're looking for venture capital or exploring bootstrapping options, having a clear strategy is essential. This comprehensive guide outlines eight practical steps to help you secure the funding you need to grow your business. H1: Assessing Funding Needs Before approaching potential investors, it's vital to have a detailed understanding of how much funding your startup requires. Break down your expected costs, such as product development, marketing, staffing, and other operational expenses. Use these figures to create a thorough cash flow forecast and financial projection. A well-prepared financial plan demonstrates to investors that you have thought through your business's needs and know exactly how the funds will be used. H2: Build a Strong Brand Identity Attracting investors requires building a powerful, cohesive brand identity. Your brand identity encompasses your company's logo, messaging, social media presence, and website design. Investors evaluate your brand to understand how you communicate your value proposition, vision, and target audience. A well-defined brand builds trust and creates a positive first impression. Ensure that your brand's narrative aligns with your goals and resonates with potential investors. H2 External Link: For tips on creating a strong brand identity, visit this guide. H3: Explore Self-Funding Options Before pursuing external funding sources, consider self-funding options such as bootstrapping. Bootstrapping involves using personal savings or funds from friends and family to get your startup off the ground. While it gives you complete control over your business, it comes with higher risks if your savings are limited. Evaluate if self-funding aligns with your business model and consider combining it with other funding options to maintain ownership while obtaining necessary capital. H3 External Link: Learn more about self-funding here. H3: Seek Venture Capital and Angel Investors For high-growth startups, venture capital and angel investors are attractive options. Venture capitalists offer substantial capital in exchange for equity in your company, while angel investors invest earlier and provide both capital and mentorship. Craft a well-constructed pitch deck, solid financial projections and have a clear exit strategy for investors when seeking venture capital or angel investments. H3 External Link: These tips can help you pitch to investors effectively. H3: Consider Crowdfunding Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise small amounts of money from a large number of people in exchange for rewards or incentives. Crowdfunding is effective for products or services with broad appeal and an engaged online community. In addition to raising funds, successful crowdfunding campaigns validate your business concept and build a customer base. Engage in significant marketing and social media efforts to make crowdfunding a viable alternative funding source. H3 External Link: Explore successful crowdfunding strategies here. H3: Apply for Business Loans Business loans provide an alternative to equity-based funding, allowing you to retain full ownership of your startup. Traditional banks and newer lending platforms like Kabbage and Funding Circle can offer the capital needed to scale your business. Secure a business loan by demonstrating a strong credit history, a detailed business plan, and evidence of cash flow. Carefully evaluate loan terms and ensure they align with your financial capabilities. H3 External Link: Discover how to secure a business loan here. H3: Research Government Grants Government grants and subsidies can provide crucial funding without repayment or surrendering equity. Research grants specifically designed for startups in industries like tech, healthcare, and green energy. Programs like Innovate UK and the UK's Startup Loan scheme offer financial assistance to innovative small businesses. Ensure your project aligns with grant objectives and adhere to eligibility criteria and application deadlines. H3 External Link: Learn more about government grants available for startups. H3: Hire a Business Coach Navigating the world of startup funding can be overwhelming, making it helpful to hire a business coach or mentor. They provide valuable guidance in refining your business model, creating a winning pitch, and connecting with potential investors. Business coaches possess extensive networks of venture capitalists, angel investors, and other funding sources. With their help, you can sharpen your fundraising strategy and position your startup for success. H3 External Link: Discover the benefits of hiring a business coach here. Conclusion: Securing startup funding may be challenging, but with a clear strategy and the right approach, you can raise the capital necessary to launch and grow your business. Assess funding needs, build a strong brand identity, and explore various funding sources, including venture capital, crowdfunding, and business loans. Prepare a solid financial plan and a compelling business narrative to increase your chances of success. By following these eight steps, you'll be well on your way to turning your entrepreneurial vision into reality. External Link: For more information on securing startup funding, visit eiindustrial.com.

- Nhận đường liên kết

- X

- Ứng dụng khác

How AI is Transforming Logistics: Unlocking New Levels of Optimization

Introduction

The logistics industry is experiencing significant changes thanks to advancements in artificial intelligence (AI). In a world where consumers demand faster deliveries, lower costs, and improved customer experiences, AI is stepping in to streamline operations, enhance decision-making, and drive efficiency in the supply chain. In this article, we will delve into the role of AI in logistics and explore how it is reshaping the future of this critical industry.

The Importance of Optimization in Modern Logistics

Optimization is the foundation of logistics. Companies constantly seek ways to improve route planning, reduce costs, and maximize efficiency in an environment where customer expectations for fast and reliable deliveries are at an all-time high. Without efficient logistics operations, businesses risk losing customers, facing higher operational costs, and contributing to environmental damage through wasted resources and excessive carbon emissions.

However, the complexity of modern supply chains presents challenges. Traditional methods often fall short when it comes to addressing dynamic changes such as fluctuating fuel costs, last-minute route changes, and unpredictable demand. This is where AI comes in, offering a solution that not only optimizes logistics processes but also learns and adapts over time.

How AI Enhances Logistics Optimization

AI and Predictive Analytics

AI's ability to analyze vast amounts of data is a game-changer for logistics. Predictive analytics powered by AI can accurately forecast demand, ensuring optimized inventory levels. AI algorithms can identify patterns in customer behavior, weather conditions, and past sales data to predict future needs. This helps businesses avoid stockouts, reduce excess inventory, and minimize wastage. AI systems can anticipate peak seasons or sudden spikes in demand and adjust inventory levels accordingly, continuously improving their predictions by learning from new data.

AI in Route Planning and Scheduling

AI-driven route optimization is revolutionizing how logistics companies plan and execute deliveries. AI analyzes real-time data such as traffic conditions, weather forecasts, and fuel consumption to suggest the most efficient delivery routes. This results in shorter delivery times, reduced fuel usage, and lower operational costs. AI systems can recommend alternate routes to bypass traffic congestion, ensuring on-time delivery and reducing delays. These systems also optimize scheduling, allowing logistics companies to maximize their fleet and reduce the number of vehicles on the road.

AI for Warehouse and Inventory Management

AI plays a crucial role in automating warehouse operations. AI-powered robots and systems streamline sorting, picking, and packing processes in large warehouses, working faster and more accurately than humans, reducing the risk of errors. AI-driven tools monitor inventory levels in real-time and automatically reorder products when stocks run low, ensuring optimal stock levels. For example, Amazon uses AI-enabled robots to automate sorting and restocking in its massive warehouses, boosting efficiency and speeding up the order fulfillment process.

Real-World Examples of AI in Logistics

Several major players in the logistics industry are already harnessing the power of AI to improve operations. Amazon uses AI for optimizing delivery routes and automating warehouse operations, enabling them to predict demand patterns and adjust inventory accordingly. UPS leverages AI-powered route optimization to minimize fuel consumption and delivery times through their ORION system. Even smaller businesses benefit from AI-driven tools that offer cloud solutions for route planning, inventory management, and demand forecasting.

The Future of AI and Logistics Optimization

AI-Powered Autonomous Vehicles

One of the most exciting innovations in logistics is the development of autonomous vehicles. AI enables these vehicles to navigate roads, avoid obstacles, and deliver goods with minimal human intervention. Autonomous trucks and drones have the potential to reduce labor costs, increase delivery speed, and improve safety. Companies like Tesla and Waymo are already testing AI-powered trucks that could soon transform the logistics landscape.

AI in Supply Chain Sustainability

As businesses become more environmentally conscious, AI plays a crucial role in enhancing supply chain sustainability. It helps reduce the carbon footprint by optimizing fuel usage, reducing waste, and improving energy efficiency. AI-powered systems analyze data from delivery trucks to identify areas where fuel consumption can be minimized, leading to greener operations. Smarter packaging solutions created with AI ensure goods are shipped efficiently, reducing excess packaging material and transportation costs.

How to Get Started with AI in Logistics

If you want to integrate AI into your logistics operations, consider the following steps:

- Identify areas of improvement: Assess where your logistics processes currently lag behind in efficiency, such as route planning, inventory management, or warehouse operations.

- Invest in AI solutions: Adopt AI-powered software or platforms specifically designed for logistics optimization. Many providers offer scalable solutions suitable for businesses of all sizes.

- Start small: Begin by implementing AI in one area, such as route planning, and gradually expand its usage throughout your logistics system.

- Monitor and adapt: Track the performance of AI and make necessary adjustments to ensure optimal results.

For more information on AI solutions for logistics, check out this guide.

Conclusion

AI is undeniably transforming the logistics industry, offering new ways to optimize operations, reduce costs, and enhance customer satisfaction. From predictive analytics to route optimization, AI is making logistics faster, smarter, and more efficient. As we look to the future, the continued integration of AI into logistics promises to unlock even more potential, from autonomous vehicles to sustainable supply chains. Now is the time for businesses to explore how AI can optimize their logistics processes and stay competitive in this rapidly evolving landscape.

External link: Read the full article on eiindustrial.com

- Nhận đường liên kết

- X

- Ứng dụng khác

Robotics in Manufacturing: Enhancing Productivity and Safety

- Nhận đường liên kết

- X

- Ứng dụng khác

Referral marketing is a powerful strategy that goes beyond customer acquisition and plays a key role in building lasting connections with customers. In today's digital age, businesses are constantly seeking innovative ways to stand out and foster trust within their target audience. One strategy that has proven to be effective is referral marketing, which leverages satisfied customers to become brand advocates and amplify brand visibility.

The Power of B2B Referrals: Turning Satisfied Customers into Brand Advocates

Referral marketing is based on the simple concept of leveraging the trust people have in recommendations from those they know. Research shows that 92% of consumers trust referrals from individuals they are acquainted with, making it one of the most reliable forms of advertising. Moreover, referred customers have a 37% higher retention rate and a 16% greater lifetime value than non-referred customers, showcasing the long-term value of referrals.

Understanding the Impact of Referral Marketing Strategies

Referral marketing is not just about acquiring new customers; it also drives profitability and fosters customer loyalty. Referred customers convert at a 30% higher rate than leads from other channels, leading to increased profit margins of up to 25%. Additionally, referral marketing generates 65% of new business opportunities, making it a valuable lead-generation method for businesses of all sizes.

When Referrals Work and When They Don't

While referrals can be a game-changer for businesses, there are challenges that need to be addressed. Trust is crucial for the success of a referral program, and referrals based on personal biases or familial connections can harm the trust a company has built. It is also important to ensure that referred individuals are a good cultural fit for the company to avoid productivity issues. Recognizing and rewarding successful referrals is essential to encourage future referrals and capitalize on missed opportunities.

Assessing the Suitability of Referral Marketing for Your Business

Before implementing a referral marketing strategy, it is important to evaluate whether your customer base is suitable for such an approach. Analyzing customer demographics, purchasing behavior, and satisfaction levels can help determine if your existing customers are likely to act as brand ambassadors. Additionally, assessing the uniqueness and value of your product or service in the marketplace can help determine if referral marketing is a good fit for your business.

Key Factors Affecting Referral Success

Several factors contribute to the success of a referral marketing program, including aligned incentives, a simplified referral process, and strong customer relationships. Incentives for both the referrer and the referred customer should be compelling to motivate action, while a streamlined referral process increases the likelihood of referrals. Trust and strong customer relationships are essential for ensuring that referrals are authentic and effective.

Creative Referral Marketing Strategies That Resonate

Innovative businesses are finding creative ways to enhance their referral programs beyond monetary rewards. Unique incentives such as exclusive experiences or early access to new products can drive engagement. Collaborating with complementary brands and gamifying the referral process can also increase participation and expand your network of potential customers. Integrating referral links into email marketing campaigns can further promote referrals and incentivize customers to participate.

The Significance of KPIs in Referral Programs

Measuring the success of a referral program is essential for optimizing its effectiveness. Key performance indicators (KPIs) such as Net Promoter Score (NPS), customer satisfaction, and customer retention rate can help assess the impact of your referral program on customer loyalty and business growth. Monitoring these KPIs enables businesses to refine their referral strategies and drive meaningful results.

Success Stories of Referral Marketing in the Enterprise B2B Space

Several companies in the B2B sector have achieved remarkable success through referral marketing. Dropbox's referral program led to a 3900% increase in user growth, while Blackbaud and Airtable saw revenue growth and user expansion through their referral programs. These success stories highlight the power of customer advocacy and the importance of building a strong referral community.

Building a Strong Referral Community

At the core of any successful referral program is a community of brand advocates who genuinely believe in your product or service. By nurturing this community and encouraging satisfied customers to become brand advocates, businesses can create a sustainable cycle of referrals, customer acquisition, and loyalty. Referral marketing is a powerful strategy that not only drives profitability but also fosters trust and long-term success in today's competitive business landscape.

To read more about the power of B2B referrals and how to turn satisfied customers into brand advocates, visit this link.

- Nhận đường liên kết

- X

- Ứng dụng khác

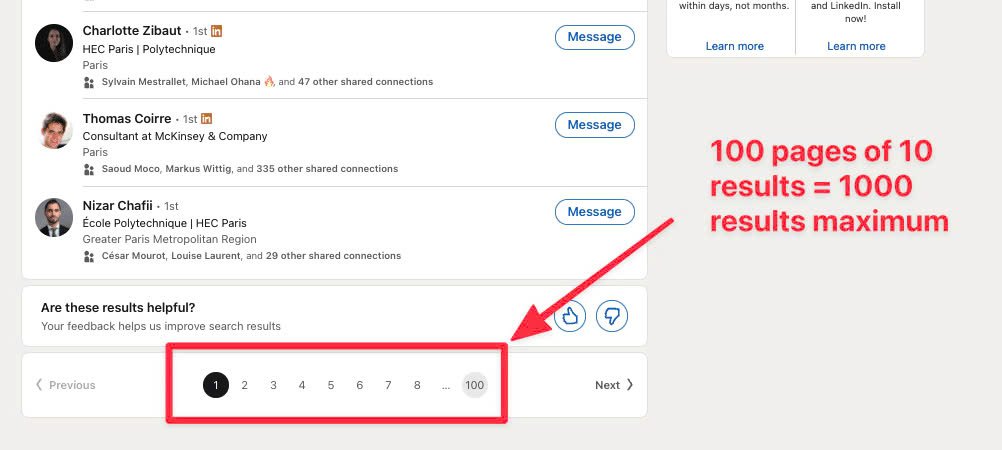

LinkedIn has emerged as a powerhouse platform for B2B lead generation in today’s digital landscape. With a vast network of over 900 million professionals, businesses can leverage LinkedIn to connect with decision-makers, nurture leads, and drive conversions effectively. If utilized strategically, LinkedIn can revolutionize your B2B lead generation strategy.

Why LinkedIn for B2B Lead Generation?

LinkedIn stands out as a professional networking site tailored to facilitate business connections. Its exclusive focus on the professional sphere makes it an ideal space for B2B marketing and lead generation. Here’s why LinkedIn is a game-changer:

- **Targeted Audience**: LinkedIn boasts a user base comprising professionals, including key decision-makers and industry experts, allowing businesses to reach their desired audience.

- **Data-Driven Targeting**: The platform offers advanced search and targeting tools to filter potential leads based on job titles, industries, company sizes, and locations, ensuring precise reach.

- **Content Distribution**: LinkedIn provides the avenue to share thought leadership content, enhance brand visibility, and nurture relationships through posts, articles, and direct messaging.

Best Practices for LinkedIn B2B Lead Generation

1. Optimize Your Profile

Your LinkedIn profile serves as the initial impression potential leads have of your business. Optimize it for lead generation with the following tactics:

- **Professional Headline**: Craft a clear, concise headline highlighting your expertise.

- **Profile Summary**: Write a compelling summary emphasizing how your business addresses audience pain points and include relevant keywords.

- **Call to Action (CTA)**: Incorporate a strong CTA at the end of your profile summary to encourage connections, meetings, or website visits.

2. Leverage LinkedIn Search and Filters

Utilize LinkedIn’s advanced search functionalities to narrow down your audience based on various filters such as job titles, industries, and locations. Enhance your search effectiveness by:

- Using Boolean search techniques for specific prospect identification.

- Filtering search results by location, industry, and job function to target decision-makers effectively.

3. Share Valuable Content Regularly

Position yourself as an industry authority by frequently sharing valuable, industry-specific content. Engage your audience by:

- Creating thought leadership articles showcasing expertise.

- Interacting with followers to build relationships.

- Using video content for engaging communication.

4. Join and Participate in LinkedIn Groups

Engage with professionals in similar sectors by joining relevant LinkedIn Groups. Benefits include:

- Building trust with potential leads through contributions.

- Promoting content to drive traffic to your profile or website.

5. Use LinkedIn InMail for Direct Outreach

Utilize LinkedIn InMail for personalized outreach to establish direct contact with decision-makers. Maximize InMail efforts by:

- Personalizing each message.

- Keeping messages concise.

- Following up if no immediate response.

6. Run LinkedIn Ads

Consider utilizing LinkedIn Ads to bolster your B2B lead generation strategy. Different ad formats can help target specific audiences effectively:

- Sponsored Content.

- Lead Gen Forms.

- Sponsored InMail.

7. Nurture Leads with LinkedIn Automation Tools

Leverage LinkedIn automation tools for efficient outreach and follow-ups while balancing personalization for enhanced relationship building.

Measuring LinkedIn Lead Generation Success

Key metrics to track for gauging the success of your LinkedIn lead generation efforts include connection requests, engagement rate, InMail response rate, and leads generated. Regularly analyzing these metrics helps identify areas for improvement.

Conclusion

In conclusion, LinkedIn presents unparalleled opportunities for B2B lead generation, enabling businesses to connect with decision-makers, showcase expertise, and foster relationships. By implementing the mentioned best practices, such as profile optimization, content sharing, and strategic outreach, you can elevate your lead generation efforts and witness business growth through LinkedIn. Unlock the full potential of LinkedIn for your B2B lead generation strategy today and witness your network—and leads—flourish.

[Read more](https://eiindustrial.com/leveraging-linkedin-for-b2b-lead-generation-best-practices/) about leveraging

- Nhận đường liên kết

- X

- Ứng dụng khác

**Account-Based Marketing (ABM): A Targeted Approach to B2B Sales** In today’s highly competitive B2B landscape, businesses are constantly looking for ways to personalize their marketing efforts and drive meaningful engagement. One approach gaining significant traction is **account-based marketing (ABM)**. Unlike traditional B2B marketing, which casts a wide net to generate leads, ABM takes a more focused, strategic approach by targeting a specific set of high-value accounts. By aligning sales and marketing teams, ABM ensures that the right message reaches the right person at the right time, leading to stronger relationships and better conversion rates. According to the **Demand Metric "ABM Adoption Benchmark Report"**, 60% of companies using ABM for at least a year reported increased revenue, demonstrating the tangible benefits of this approach. **How Does Account-Based Marketing Work?** At its core, ABM views each target account as a “market of one,” with personalized marketing efforts directed at key decision-makers within that account. Traditional B2B marketing campaigns aim to attract a broad audience, but ABM focuses on a few high-value prospects, delivering content and messaging that resonate with their specific needs. Examples of ABM in action include sending highly personalized emails, offering exclusive content, or notifying key contacts about relevant events or offers. The goal is to create ongoing business relationships through tailored interactions that address the unique needs of each account. However, ABM success depends on selecting the right accounts. Not every prospect qualifies for an ABM campaign. The ideal accounts are those with the highest revenue potential or strategic value to your business. **What Makes a Good ABM Account?** Choosing the right accounts for an ABM campaign is crucial, and it can be challenging for many marketers and sales professionals. While criteria may vary by industry, the following factors are key when identifying a good ABM account: - **Revenue potential**: Since ABM campaigns require more resources, the selected accounts must have the potential to deliver a strong return on investment. - **Purchase history**: Consider past interactions with your business and competitors. - **Sales funnel position**: Target accounts that are actively moving through your sales pipeline. - **Ideal customer profile (ICP) alignment**: The account should match your ICP, ensuring their needs align with your offerings. It’s also important to assess whether the account will help you achieve specific business goals. For example, are you looking to engage with recognizable brands, re-establish relationships with lapsed accounts, or expand geographically? Identifying these factors will help narrow your focus to the accounts that matter most. **ABM vs. Lead Generation** While lead generation is a fundamental component of many marketing strategies, it takes on a different role in ABM. Lead generation typically involves attracting a broad range of prospects through various channels, such as email, social media, or events. In contrast, **ABM focuses on generating leads within a narrow set of high-value accounts**, aiming to engage multiple stakeholders within those accounts. ABM narrows the focus to high-impact relationships, with the goal of expanding your influence within a target account and nurturing deeper engagement with different decision-makers. **The Role of Lead Scoring in ABM** Lead scoring is an essential element of account-based marketing. It involves ranking leads based on their likelihood to convert, using behavioral and engagement data to prioritize the most promising prospects within a target account. This allows marketing and sales teams to focus on leads that are most likely to take action, ensuring that resources are spent efficiently. **The Benefits of Account-Based Marketing** There are several key benefits to implementing an ABM strategy: 1. **Sales and Marketing Alignment** ABM requires close coordination between sales and marketing teams. Both teams must align from the beginning to ensure that data-driven decisions are made throughout the sales cycle. This alignment leads to a more seamless and effective strategy, where both teams work together toward common goals. 2. **Higher ROI** Because ABM is highly targeted and personalized, it tends to deliver a higher return on investment (ROI) than traditional B2B marketing efforts. Focusing on key accounts means fewer wasted resources and more meaningful engagements with decision-makers. 3. **Shorter Sales Cycles** ABM accelerates the sales process by eliminating unqualified prospects early on. Since marketing efforts are directed only at accounts with the highest potential, sales teams can focus on nurturing those relationships, leading to faster conversions. **How to Develop a Successful ABM Campaign** To ensure a successful ABM campaign, follow these steps: 1. **Define Clear Goals**: Start by setting your goals. Are you looking to increase revenue, build brand awareness, or re-engage lapsed clients? Once you’ve established clear objectives, create a plan of action with defined timelines, budgets, and KPIs. 2. **Select Target Accounts**: Carefully select the accounts you want to target based on your ideal customer profile, revenue potential, and strategic value.

- Nhận đường liên kết

- X

- Ứng dụng khác

Crowdfunding Success for Industrial Projects: Strategies to Secure Funding Crowdfunding has emerged as a powerful tool for industrial projects seeking financial backing. However, achieving success in the crowdfunding space requires more than just a good idea. To stand out in a competitive landscape and secure investments for your industrial project, strategic approaches are essential. Here are some key strategies to ensure your industrial project thrives in the world of crowdfunding. ### 1. Create a Compelling Narrative A compelling story lies at the heart of every successful crowdfunding campaign. For industrial projects, it is crucial to not only explain what your project does but also why it matters. Potential investors are more likely to support projects with clear objectives and tangible societal benefits. For instance, if your industrial project focuses on renewable energy or automation, emphasize how it will contribute to the larger ecosystem. Highlight the problem you are solving and showcase why your project is an essential innovation in your industry. To craft a compelling narrative, make sure your campaign includes: - Clear project goals - Visuals such as concept designs, prototypes, or videos - Real-world impact projections (e.g., savings, efficiency, sustainability benefits) ### 2. Offer Transparent Financial Planning Transparency is key when it comes to financial planning for industrial projects seeking funding. Clear and detailed financial projections can make or break your crowdfunding campaign. Industrial projects typically require significant upfront capital, so providing potential backers with a comprehensive breakdown of how funds will be used is crucial. Include details on: - Material Costs: Identify raw materials and manufacturing components. - Labor Costs: Specify expenses related to workforce, including engineers or technicians. - Development Timeline: Outline the duration of each project phase and the associated costs. ### 3. Build a Community Before Launch Creating a supportive and engaged community before launching your industrial project's crowdfunding campaign can significantly increase its chances of success. Utilize social media, newsletters, and industry networking events to generate early interest and build relationships with potential backers. Engage with your community early on by: - Providing regular updates on your project's progress - Soliciting feedback to refine your pitch - Hosting webinars or discussions to introduce potential backers to the project ### 4. Leverage Social Proof to Build Momentum Social proof plays a critical role in crowdfunding success. Obtaining early backing, especially from reputable individuals or organizations, can create trust and momentum for your campaign. Secure high-profile endorsements or partnerships before launching and offer exclusive deals or rewards to early backers. By establishing social proof early on, your project will gain traction rapidly and maintain steady interest throughout the campaign. ### 5. Offer Relevant and Valuable Rewards Incentivizing backers with relevant and valuable rewards can significantly enhance your crowdfunding campaign's success. Align rewards closely with your project, making them appealing to both individual contributors and potential corporate partners. Examples of rewards for industrial projects include exclusive access to new technology, the opportunity to influence design decisions, and product discounts. While industrial projects often attract equity or large-scale backers, offering perks to smaller investors can help create a diverse pool of supporters. ### 6. Utilize Targeted Marketing and Outreach A well-planned marketing strategy is critical for the success of your crowdfunding campaign. Tailoring your messaging to specific audiences, such as industry professionals, engineers, or eco-conscious investors, can significantly impact the outcomes. Use social media outreach, press and media coverage, and video campaigns to connect with potential backers and spread the word about your project. Consistent communication and regular updates during the campaign are key to keeping your backers engaged and encouraging additional contributions. ### 7. Consider Hybrid Funding Models Incorporating hybrid funding models that combine crowdfunding with institutional investments or grants can enhance your industrial project's chances of success. By diversifying your capital sources and demonstrating wider support, you can appeal to potential investors and reduce perceived risk. ### 8. Focus on Post-Campaign Engagement Securing funding through crowdfunding is just the beginning. Maintaining strong engagement with your backers after the campaign ends is crucial. Provide regular updates on your project's progress through email newsletters or a dedicated platform to build trust and foster long-term relationships with your supporters. In conclusion, crowdfunding offers industrial projects a unique opportunity to secure funding and build a community of engaged supporters. By creating a compelling narrative, offering transparent financial planning, building early engagement, and leveraging social proof, industrial innovators can harness the potential of crowdfunding to bring their projects to life. Embrace these strategies to position your industrial project for success in the evolving landscape of the industrial sector. For further insights on crowdfunding success for industrial projects, visit [EI Industrial](https://eiindustrial.com/crowdfunding-success-for-industrial-projects-strategies-to-secure-funding/).

- Nhận đường liên kết

- X

- Ứng dụng khác

Title: Exploring Venture Capital Trends in the Industrial Sector In today's rapidly evolving industrial landscape, venture capital (VC) plays a crucial role in driving innovation and growth. With a focus on technological advancements and sustainability, VC investors are increasingly looking towards the industrial sector for lucrative investment opportunities. In this blog post, we will delve into the key trends and opportunities shaping venture capital in the industrial sector. ### Green Technology and Sustainability in the Industrial Sector One of the major trends driving venture capital investments in the industrial sector is the focus on green technology and sustainability. With a growing emphasis on environmental, social, and governance (ESG) principles, VC investors are pouring funds into startups that develop eco-friendly solutions. From renewable energy sources to carbon capture technologies, the push for sustainability is reshaping traditional industries like manufacturing and logistics. Key areas within this trend include: - Circular economy initiatives - Energy-efficient manufacturing - Water conservation technologies  ### Industrial Automation and Robotics Automation is the future of manufacturing, and startups driving innovations in robotics, artificial intelligence (AI), and machine learning are attracting significant venture capital investments. The implementation of smart factories, where machines operate autonomously, is revolutionizing traditional production processes. VC investors are keen on startups leveraging robotic process automation, AI-driven supply chains, and predictive maintenance to enhance productivity and efficiency. ### 3D Printing and Advanced Manufacturing Additive manufacturing, or 3D printing, is transforming industrial production by offering cost-effective and flexible manufacturing options. Venture capital is flowing into startups offering 3D printing solutions, including metal 3D printing, on-demand production, and customization. As industries explore the benefits of 3D printing, VC investments in this space continue to rise.  ### Industrial IoT and Data-Driven Manufacturing The Industrial Internet of Things (IIoT) is enabling better connectivity and data collection across manufacturing processes. VC investors are particularly interested in IIoT solutions that offer real-time monitoring, big data analytics, and digital twins. Investments in IIoT are driving the development of smart factories and data-driven manufacturing ecosystems. ### Supply Chain Innovation and Resilience Disruptions in global supply chains have highlighted the need for innovative solutions to improve resilience and efficiency. Venture capitalists are funding startups that offer blockchain solutions for supply chain transparency, AI-based demand forecasting, and last-mile delivery optimization. By focusing on supply chain innovation, VC investors are helping industries mitigate risks and adapt to new market challenges. ### Energy Storage and Electric Vehicles Energy storage and electric vehicles are key components of the industrial sector's shift towards sustainable energy solutions. VC investments are supporting startups developing advanced energy storage systems and EV infrastructure. Key trends in this space include battery innovation, EV supply chain development, and grid integration.  ### Conclusion The industrial sector presents a wealth of opportunities for venture capital investment, particularly in emerging trends like green technology, automation, and supply chain innovation. By focusing on sustainability, automation, and data-driven manufacturing, VC investors can drive innovation and unlock new avenues for success in the industrial landscape. As industries continue to evolve, those who invest in these emerging sectors stand to benefit from the future of industry. External Link: [Read More about Venture Capital Trends in the Industrial Sector](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/) --- By exploring these key trends and investment themes, venture capitalists can stay ahead of the curve and capitalize on the transformative opportunities in the industrial sector. Venture capital is playing a pivotal role in driving innovation, efficiency, and sustainability across various industrial domains, making it an exciting time for both startups and established companies in the industry.

- Nhận đường liên kết

- X

- Ứng dụng khác

A Comprehensive Guide to Securing Startup Funding: 8 Essential Steps for Entrepreneurs Securing funding is a critical task for startup founders, whether they are seeking venture capital or exploring bootstrapping options. Having a clear strategy is essential to attract investors and grow your business successfully. In this blog post, we outline eight practical steps to help you secure the funding you need: ### Step 1: Assess How Much Funding You Need Before approaching potential investors, it is vital to have a detailed understanding of the funding your startup requires. Create a thorough cash flow forecast and financial projection by breaking down expected costs such as product development, marketing, and staffing. Including a safety margin for unexpected expenses increases your credibility in the eyes of investors. ### Step 2: Build a Strong Brand Identity Investors look for startups with a powerful brand identity that communicates the value proposition, vision, and target audience clearly. Your brand should tell a compelling story that aligns with your goals and resonates with potential investors. Spend time refining your brand narrative to build trust and make a positive first impression.  ### Step 3: Explore Self-Funding Consider bootstrapping as a self-funding option using personal savings or funds from friends and family. While it gives you control over your business without giving away equity, it comes with higher risks. Evaluate if self-funding is suitable for your startup's overhead costs and revenue generation potential.  ### Step 4: Seek Out Venture Capital and Angel Investors For high-growth startups, venture capital and angel investors provide substantial capital in exchange for equity. Ensure you have a well-constructed pitch deck, solid financial projections, and a clear exit strategy when pitching to these investors. ### Step 5: Consider Crowdfunding Crowdfunding platforms like Kickstarter and Indiegogo enable startups to raise funds from a large number of people in exchange for rewards. Successful crowdfunding campaigns can validate your business concept and build a customer base, making it a viable alternative to traditional funding sources.  ### Step 6: Apply for Business Loans Business loans provide an alternative to equity-based funding, allowing you to retain full ownership of your startup. Evaluate the terms of the loan agreement, including interest rates and repayment schedules, to ensure it aligns with your financial capabilities. ### Step 7: Research Government Grants Government grants and subsidies offer crucial funding without the need to repay or give up equity. Research eligibility criteria and application deadlines for programs like Innovate UK and the UK’s Startup Loan scheme to secure financial assistance for your startup. ### Step 8: Hire a Business Coach Navigating the world of startup funding can be overwhelming, especially for first-time entrepreneurs. Hiring a business coach or mentor can provide valuable guidance, helping you refine your business model, create a winning pitch, and connect with potential investors. In conclusion, securing startup funding requires a clear strategy and preparation. By following these eight steps, you'll be on your way to securing the funds needed to turn your entrepreneurial vision into reality. For more detailed information, visit [eiindustrial.com](https://eiindustrial.com/8-steps-to-securing-startup-funding-a-comprehensive-guide-for-entrepreneurs/).

- Nhận đường liên kết

- X

- Ứng dụng khác