Title: Exploring Venture Capital Trends in the Industrial Sector In today's rapidly evolving industrial landscape, venture capital (VC) plays a crucial role in driving innovation and growth. With a focus on technological advancements and sustainability, VC investors are increasingly looking towards the industrial sector for lucrative investment opportunities. In this blog post, we will delve into the key trends and opportunities shaping venture capital in the industrial sector. ### Green Technology and Sustainability in the Industrial Sector One of the major trends driving venture capital investments in the industrial sector is the focus on green technology and sustainability. With a growing emphasis on environmental, social, and governance (ESG) principles, VC investors are pouring funds into startups that develop eco-friendly solutions. From renewable energy sources to carbon capture technologies, the push for sustainability is reshaping traditional industries like manufacturing and logistics. Key areas within this trend include: - Circular economy initiatives - Energy-efficient manufacturing - Water conservation technologies  ### Industrial Automation and Robotics Automation is the future of manufacturing, and startups driving innovations in robotics, artificial intelligence (AI), and machine learning are attracting significant venture capital investments. The implementation of smart factories, where machines operate autonomously, is revolutionizing traditional production processes. VC investors are keen on startups leveraging robotic process automation, AI-driven supply chains, and predictive maintenance to enhance productivity and efficiency. ### 3D Printing and Advanced Manufacturing Additive manufacturing, or 3D printing, is transforming industrial production by offering cost-effective and flexible manufacturing options. Venture capital is flowing into startups offering 3D printing solutions, including metal 3D printing, on-demand production, and customization. As industries explore the benefits of 3D printing, VC investments in this space continue to rise.  ### Industrial IoT and Data-Driven Manufacturing The Industrial Internet of Things (IIoT) is enabling better connectivity and data collection across manufacturing processes. VC investors are particularly interested in IIoT solutions that offer real-time monitoring, big data analytics, and digital twins. Investments in IIoT are driving the development of smart factories and data-driven manufacturing ecosystems. ### Supply Chain Innovation and Resilience Disruptions in global supply chains have highlighted the need for innovative solutions to improve resilience and efficiency. Venture capitalists are funding startups that offer blockchain solutions for supply chain transparency, AI-based demand forecasting, and last-mile delivery optimization. By focusing on supply chain innovation, VC investors are helping industries mitigate risks and adapt to new market challenges. ### Energy Storage and Electric Vehicles Energy storage and electric vehicles are key components of the industrial sector's shift towards sustainable energy solutions. VC investments are supporting startups developing advanced energy storage systems and EV infrastructure. Key trends in this space include battery innovation, EV supply chain development, and grid integration.  ### Conclusion The industrial sector presents a wealth of opportunities for venture capital investment, particularly in emerging trends like green technology, automation, and supply chain innovation. By focusing on sustainability, automation, and data-driven manufacturing, VC investors can drive innovation and unlock new avenues for success in the industrial landscape. As industries continue to evolve, those who invest in these emerging sectors stand to benefit from the future of industry. External Link: [Read More about Venture Capital Trends in the Industrial Sector](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/) --- By exploring these key trends and investment themes, venture capitalists can stay ahead of the curve and capitalize on the transformative opportunities in the industrial sector. Venture capital is playing a pivotal role in driving innovation, efficiency, and sustainability across various industrial domains, making it an exciting time for both startups and established companies in the industry.

Title: Exploring Venture Capital Trends in the Industrial Sector

In today's rapidly evolving industrial landscape, venture capital (VC) plays a crucial role in driving innovation and growth. With a focus on technological advancements and sustainability, VC investors are increasingly looking towards the industrial sector for lucrative investment opportunities. In this blog post, we will delve into the key trends and opportunities shaping venture capital in the industrial sector.

### Green Technology and Sustainability in the Industrial Sector

One of the major trends driving venture capital investments in the industrial sector is the focus on green technology and sustainability. With a growing emphasis on environmental, social, and governance (ESG) principles, VC investors are pouring funds into startups that develop eco-friendly solutions. From renewable energy sources to carbon capture technologies, the push for sustainability is reshaping traditional industries like manufacturing and logistics.

Key areas within this trend include:

- Circular economy initiatives

- Energy-efficient manufacturing

- Water conservation technologies

### Industrial Automation and Robotics

Automation is the future of manufacturing, and startups driving innovations in robotics, artificial intelligence (AI), and machine learning are attracting significant venture capital investments. The implementation of smart factories, where machines operate autonomously, is revolutionizing traditional production processes. VC investors are keen on startups leveraging robotic process automation, AI-driven supply chains, and predictive maintenance to enhance productivity and efficiency.

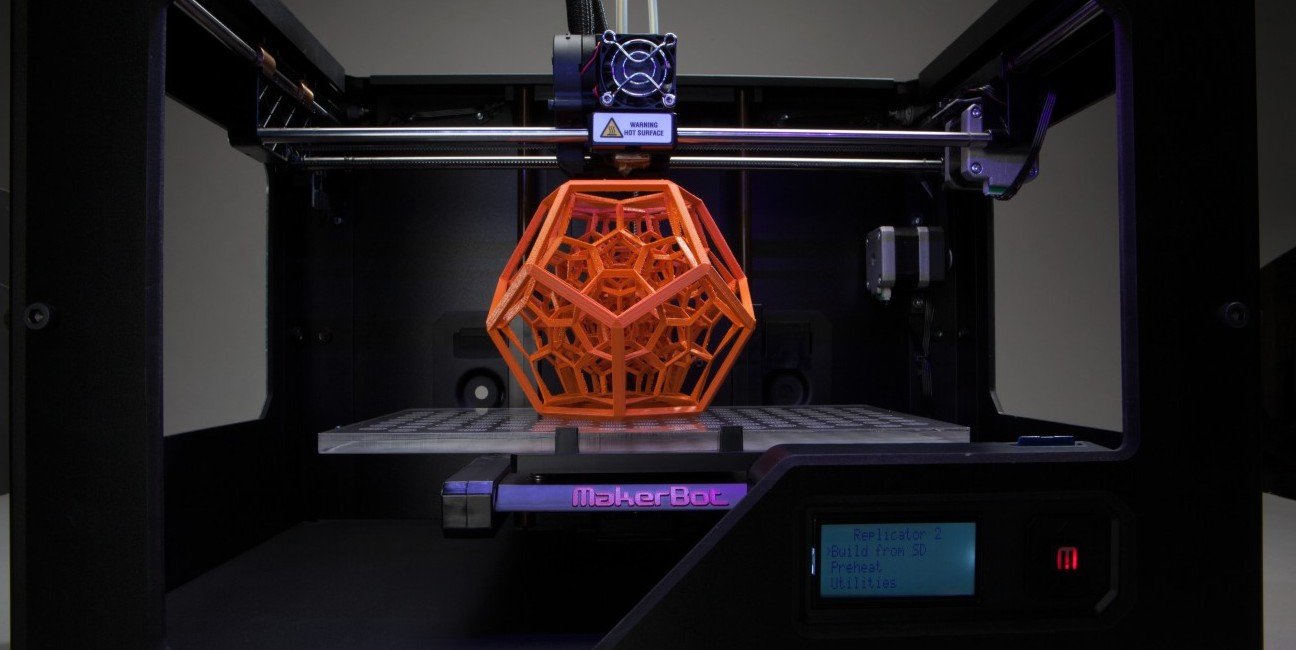

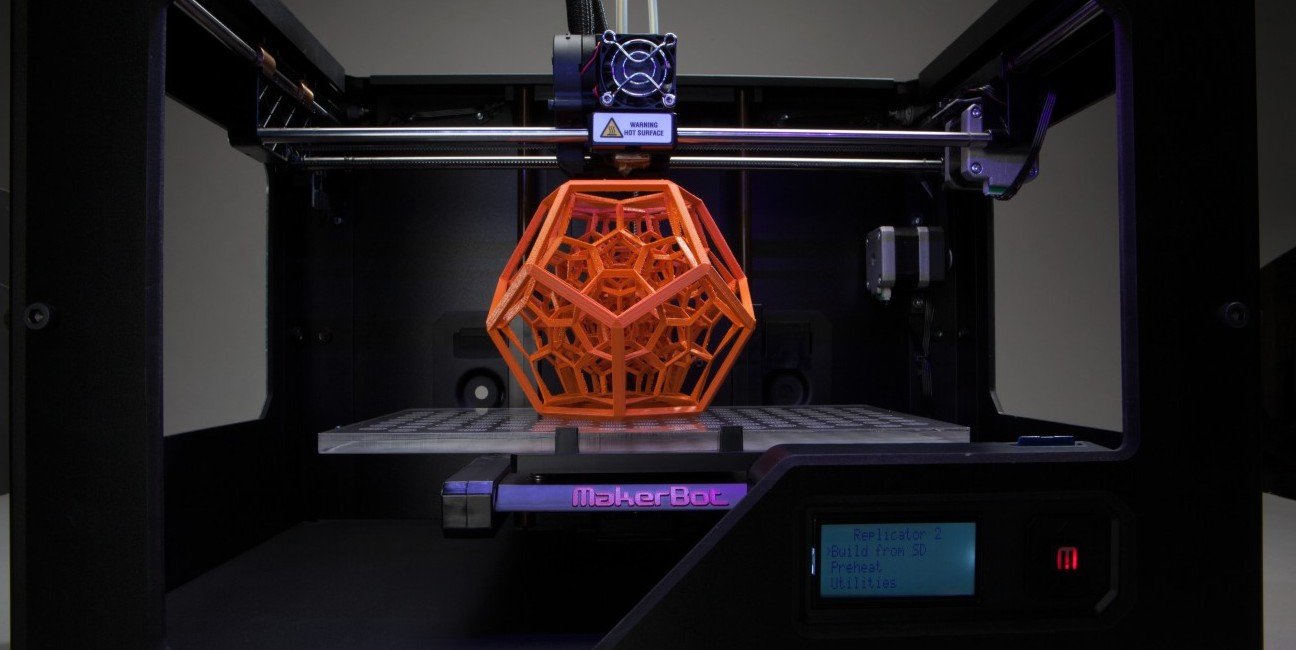

### 3D Printing and Advanced Manufacturing

Additive manufacturing, or 3D printing, is transforming industrial production by offering cost-effective and flexible manufacturing options. Venture capital is flowing into startups offering 3D printing solutions, including metal 3D printing, on-demand production, and customization. As industries explore the benefits of 3D printing, VC investments in this space continue to rise.

### Industrial IoT and Data-Driven Manufacturing

The Industrial Internet of Things (IIoT) is enabling better connectivity and data collection across manufacturing processes. VC investors are particularly interested in IIoT solutions that offer real-time monitoring, big data analytics, and digital twins. Investments in IIoT are driving the development of smart factories and data-driven manufacturing ecosystems.

### Supply Chain Innovation and Resilience

Disruptions in global supply chains have highlighted the need for innovative solutions to improve resilience and efficiency. Venture capitalists are funding startups that offer blockchain solutions for supply chain transparency, AI-based demand forecasting, and last-mile delivery optimization. By focusing on supply chain innovation, VC investors are helping industries mitigate risks and adapt to new market challenges.

### Energy Storage and Electric Vehicles

Energy storage and electric vehicles are key components of the industrial sector's shift towards sustainable energy solutions. VC investments are supporting startups developing advanced energy storage systems and EV infrastructure. Key trends in this space include battery innovation, EV supply chain development, and grid integration.

### Conclusion

The industrial sector presents a wealth of opportunities for venture capital investment, particularly in emerging trends like green technology, automation, and supply chain innovation. By focusing on sustainability, automation, and data-driven manufacturing, VC investors can drive innovation and unlock new avenues for success in the industrial landscape. As industries continue to evolve, those who invest in these emerging sectors stand to benefit from the future of industry.

External Link: [Read More about Venture Capital Trends in the Industrial Sector](https://eiindustrial.com/venture-capital-in-the-industrial-sector-key-trends-and-opportunities/)

---

By exploring these key trends and investment themes, venture capitalists can stay ahead of the curve and capitalize on the transformative opportunities in the industrial sector. Venture capital is playing a pivotal role in driving innovation, efficiency, and sustainability across various industrial domains, making it an exciting time for both startups and established companies in the industry.

Nhận xét

Đăng nhận xét