LinkedIn has emerged as a powerhouse platform for B2B lead generation in today’s digital landscape. With a vast network of over 900 million professionals, businesses can leverage LinkedIn to connect with decision-makers, nurture leads, and drive conversions effectively. If utilized strategically, LinkedIn can revolutionize your B2B lead generation strategy.

Why LinkedIn for B2B Lead Generation?

LinkedIn stands out as a professional networking site tailored to facilitate business connections. Its exclusive focus on the professional sphere makes it an ideal space for B2B marketing and lead generation. Here’s why LinkedIn is a game-changer:

- **Targeted Audience**: LinkedIn boasts a user base comprising professionals, including key decision-makers and industry experts, allowing businesses to reach their desired audience.

- **Data-Driven Targeting**: The platform offers advanced search and targeting tools to filter potential leads based on job titles, industries, company sizes, and locations, ensuring precise reach.

- **Content Distribution**: LinkedIn provides the avenue to share thought leadership content, enhance brand visibility, and nurture relationships through posts, articles, and direct messaging.

Best Practices for LinkedIn B2B Lead Generation

1. Optimize Your Profile

Your LinkedIn profile serves as the initial impression potential leads have of your business. Optimize it for lead generation with the following tactics:

- **Professional Headline**: Craft a clear, concise headline highlighting your expertise.

- **Profile Summary**: Write a compelling summary emphasizing how your business addresses audience pain points and include relevant keywords.

- **Call to Action (CTA)**: Incorporate a strong CTA at the end of your profile summary to encourage connections, meetings, or website visits.

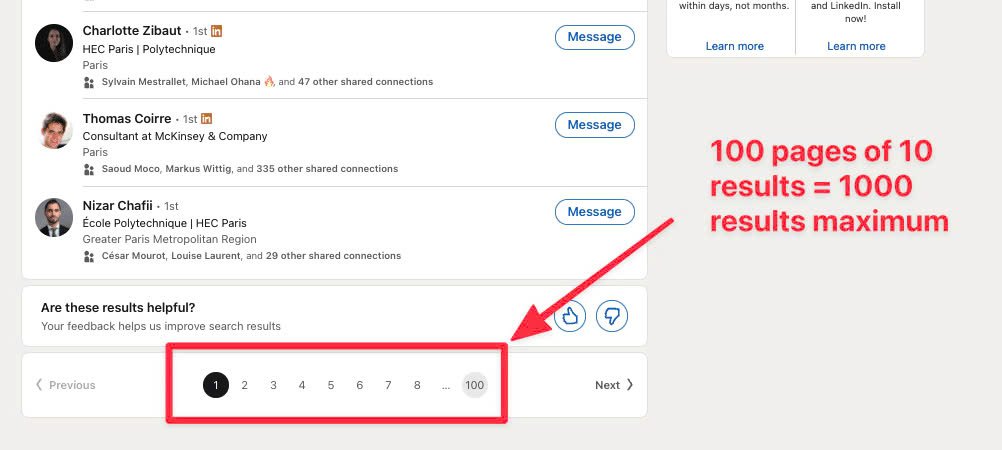

2. Leverage LinkedIn Search and Filters

Utilize LinkedIn’s advanced search functionalities to narrow down your audience based on various filters such as job titles, industries, and locations. Enhance your search effectiveness by:

- Using Boolean search techniques for specific prospect identification.

- Filtering search results by location, industry, and job function to target decision-makers effectively.

3. Share Valuable Content Regularly

Position yourself as an industry authority by frequently sharing valuable, industry-specific content. Engage your audience by:

- Creating thought leadership articles showcasing expertise.

- Interacting with followers to build relationships.

- Using video content for engaging communication.

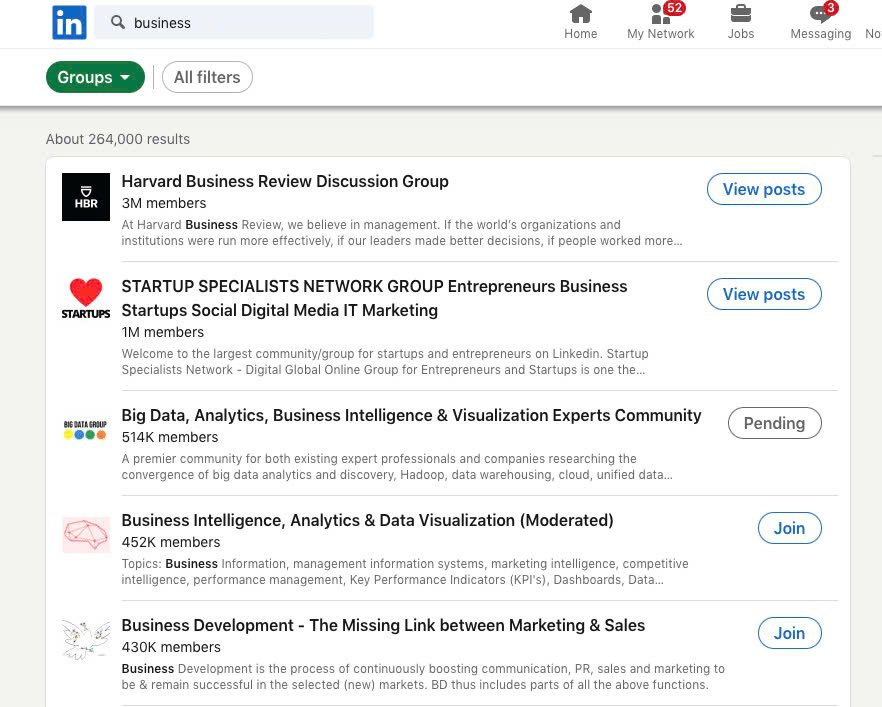

4. Join and Participate in LinkedIn Groups

Engage with professionals in similar sectors by joining relevant LinkedIn Groups. Benefits include:

- Building trust with potential leads through contributions.

- Promoting content to drive traffic to your profile or website.

5. Use LinkedIn InMail for Direct Outreach

Utilize LinkedIn InMail for personalized outreach to establish direct contact with decision-makers. Maximize InMail efforts by:

- Personalizing each message.

- Keeping messages concise.

- Following up if no immediate response.

6. Run LinkedIn Ads

Consider utilizing LinkedIn Ads to bolster your B2B lead generation strategy. Different ad formats can help target specific audiences effectively:

- Sponsored Content.

- Lead Gen Forms.

- Sponsored InMail.

7. Nurture Leads with LinkedIn Automation Tools

Leverage LinkedIn automation tools for efficient outreach and follow-ups while balancing personalization for enhanced relationship building.

Measuring LinkedIn Lead Generation Success

Key metrics to track for gauging the success of your LinkedIn lead generation efforts include connection requests, engagement rate, InMail response rate, and leads generated. Regularly analyzing these metrics helps identify areas for improvement.

Conclusion

In conclusion, LinkedIn presents unparalleled opportunities for B2B lead generation, enabling businesses to connect with decision-makers, showcase expertise, and foster relationships. By implementing the mentioned best practices, such as profile optimization, content sharing, and strategic outreach, you can elevate your lead generation efforts and witness business growth through LinkedIn. Unlock the full potential of LinkedIn for your B2B lead generation strategy today and witness your network—and leads—flourish.

[Read more](https://eiindustrial.com/leveraging-linkedin-for-b2b-lead-generation-best-practices/) about leveraging

LinkedIn has emerged as a powerhouse platform for B2B lead generation in today’s digital landscape. With a vast network of over 900 million professionals, businesses can leverage LinkedIn to connect with decision-makers, nurture leads, and drive conversions effectively. If utilized strategically, LinkedIn can revolutionize your B2B lead generation strategy.

Nhận xét

Đăng nhận xét